20 Changes to BC Real Estate Rules Since 2010 – and Why You Need a Mortgage Broker

British Columbia’s real estate landscape has changed dramatically over the past 15 years. Since 2010, we've seen waves of new legislation, tax policies, zoning reforms, and consumer protections that affect how homes are bought, sold, financed—and lived in.

Whether you're a first-time homebuyer or a seasoned investor, keeping up with all these changes can feel overwhelming. That’s why working with a knowledgeable

mortgage broker has become more important than ever.

Here are

20 key real estate changes in BC since 2010—and how they affect you.

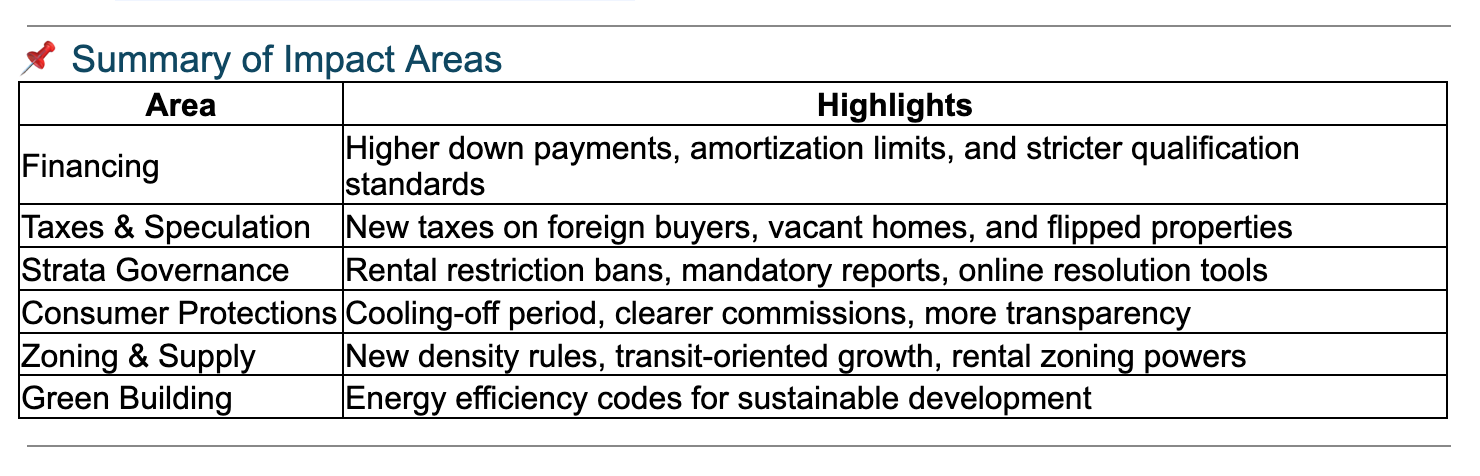

🏦 1. Stricter Mortgage Down Payment Rules

- 2010: A 20% minimum down payment was introduced for rental properties.

- 2011: The maximum amortization for insured mortgages dropped from 35 to 30 years.

- 2012: For homes over $1 million, a 20% down payment became mandatory.

📉 2. Tiered Down Payment System Introduced

- 2016: Buyers must put down 10% on the portion of a home’s price between $500,000 and $1 million. Insured borrowers must qualify at the higher benchmark rate.

🏘️ 3. Strata Rental and Age Restrictions Reformed

- 2022: BC banned most rental restriction bylaws for strata buildings. Age restrictions are now limited to 55+ only.

📊 4. Depreciation Reports Mandated

- July 1, 2024: All strata corporations with 5+ units must update depreciation reports every five years.

🌍 5. Foreign Buyer and Speculation Taxes

- 2016: Aug. 2 A 15% Foreign Buyer Tax was introduced, later raised to 20% Feb. 20, 2018

- 2018: Speculation and Vacancy Tax implemented in designated regions (Metro Vancouver, Victoria, Kelowna, Nanaimo, Central Okanagan).

🏷️ 6. Expanded Tax Zones

- 2018 & 2023 & 2024 Foreign Buyer and Speculation Tax zones expanded to include more areas in BC

🏠 7. Homebuyer Cooling-Off Period

- 2023: Buyers now have a mandatory 3-day “rescind” period after contract acceptance, offering time to reconsider (get financing, home inspection, appraisal etc.).

🧾 8. Home Flipping Tax Introduced

- January 2025: Properties sold within one year of purchase may face a 20% provincial tax on profits, tapering to zero by year two.

📈 9. Realtor Commissions Under Review

- 2024–2025: Ongoing lawsuits and policy scrutiny are prompting potential reforms to how commissions are structured.

🏛️ 10. End of Industry Self-Regulation

- 2016: Real estate regulation shifted from industry-led to government-supervised under the Real Estate Services Act (RESA).

🏢 11. Updated Real Estate Services Rules

- 2021–2022: Licensing, brokerage relationships, and realtor conduct rules were revised to improve consumer protection.

🌡️ 12. BC Energy Step Code Introduced

- 2017: New energy-efficiency standards aim for all new homes to be net-zero ready by 2032.

🚫 13. Elimination of Single-Family Zoning

- 2023–2024: Municipalities can no longer enforce single-family-only zoning. Multiplex and infill housing is now permitted in urban areas.

🚆 14. Density & Parking Near Transit

- 2023–2024: Provincial rules increased allowable density near transit hubs and removed minimum parking requirements.

🏨 15. Stricter Short-Term Rental Rules

- 2023–2024: Airbnb-style rentals are restricted or banned in many urban areas unless the unit is a principal residence.

🛖 16. Single-Stair Apartments Now Allowed

- 2023–2024: Low-rise apartment buildings can now use single-staircase construction, lowering development costs.

📈 17. No Public Hearings for Code-Compliant Projects

- 2023–2024: Projects that already meet zoning and building code can bypass public hearings to accelerate approvals.

🏙️ 18. Municipal Rental-Only Zoning Powers

- 2018 & 2023: Cities can enforce rental-only zoning and monitor housing supply more closely.

🌾 19. Farmland "Monster Home" Limits

- 2018–2021: Principal dwellings on ALR land are limited to 500 m², with rules around secondary dwellings tightened.

🏘️ 20. Strata Disputes Handled by Civil Resolution Tribunal (CRT)

- 2016: The CRT gained authority to resolve strata and small claims disputes online—streamlining resolution for owners and tenants alike.

Why You Need to Work with a Mortgage Broker

The last 15 years of real estate reform in BC haven’t just affected home prices—they’ve reshaped how homes are bought, sold, and financed. That’s why working with a professional mortgage broker isn’t just helpful—it’s essential.

✅ Expert Guidance

We stay up to date on every regulatory change—from the new flipping tax to strata law reforms—so you don’t have to. We’ll explain what matters and how it affects your financing.

💡 Tailored Mortgage Solutions

Every buyer has a different financial picture. We analyze your income, down payment, credit, and goals to match you with lenders that align with your unique situation—even when guidelines are shifting.

💰 Maximize Affordability

We help you navigate high down payment thresholds, mortgage stress tests, and short amortization periods to find strategies that keep your monthly payments affordable.

💼 We Advocate for You

Whether you're a first-time buyer, upsizing, or purchasing an investment property, your broker negotiates on your behalf and protects your interests.

Conclusion

With everything from zoning rules to tax policies evolving rapidly in BC, having a mortgage broker on your team means you’re not navigating it alone. You gain clarity, confidence, and access to the best possible mortgage solutions—so your real estate decisions are informed and strategic.

Need help navigating mortgage financing for BC’s ever-changing real estate market?

Let’s talk about how I can guide you through today’s rules—and help you plan for tomorrow.