Mortgage Articles

What Is BC Assessment? Every January, British Columbia homeowners receive their annual Property Assessment Notice . BC Assessment is a provincial Crown corporation responsible for valuing all real estate in British Columbia for property tax purposes. Each year, BC Assessment provides an estimate of a property’s fair market value as of July 1 of the previous year . 👉 To view the most recent assessment for any property, visit the BC Assessment website and search by address. Important things to understand about BC Assessments Timing matters. Your 2026 assessment reflects an estimated market value as of July 1, 2025, not today. Markets change quickly. In active or volatile markets (like Greater Vancouver and the Fraser Valley), values can shift significantly in a matter of months. Mass appraisal methods are used. BC Assessment relies on algorithms and broad market data rather than a detailed, in-person inspection of your specific home. Because of this, an assessed value can differ — sometimes substantially — from: a lender-ordered mortgage appraisal, or a private real estate appraisal completed for buying or selling. BC real estate context (2026) As we move through 2026, BC housing markets continue to be influenced by: interest-rate expectations and changes by the Bank of Canada, affordability pressures, regional supply constraints, and local economic conditions. This means BC Assessment values should be used only as a starting point , not as a precise indicator of what a property will sell for or what a lender will accept as value. Bottom line: Do not rely on BC Assessment for the exact value of a property you’re planning to sell, purchase or refinance.

Buying a home is one of the most important financial decisions you will make and tends to be stressful with all the new terminology. To help you understand the process and have confidence in your choices, check out the following common terms you will encounter during the home buying process. Amortization – Length of time…

Buying a home is one of the biggest financial moves you’ll ever make — and along with it comes a whole lot of new terms, rules, and (you guessed it) insurance . You might think “Mortgage insurance… how complicated can that be?” But once you start hearing about default insurance , mortgage life insurance , and home insurance , it’s easy to get lost in the fine print. Don’t worry — this guide breaks it all d own so you can feel confident about what each type does, what it costs, and why it matters.

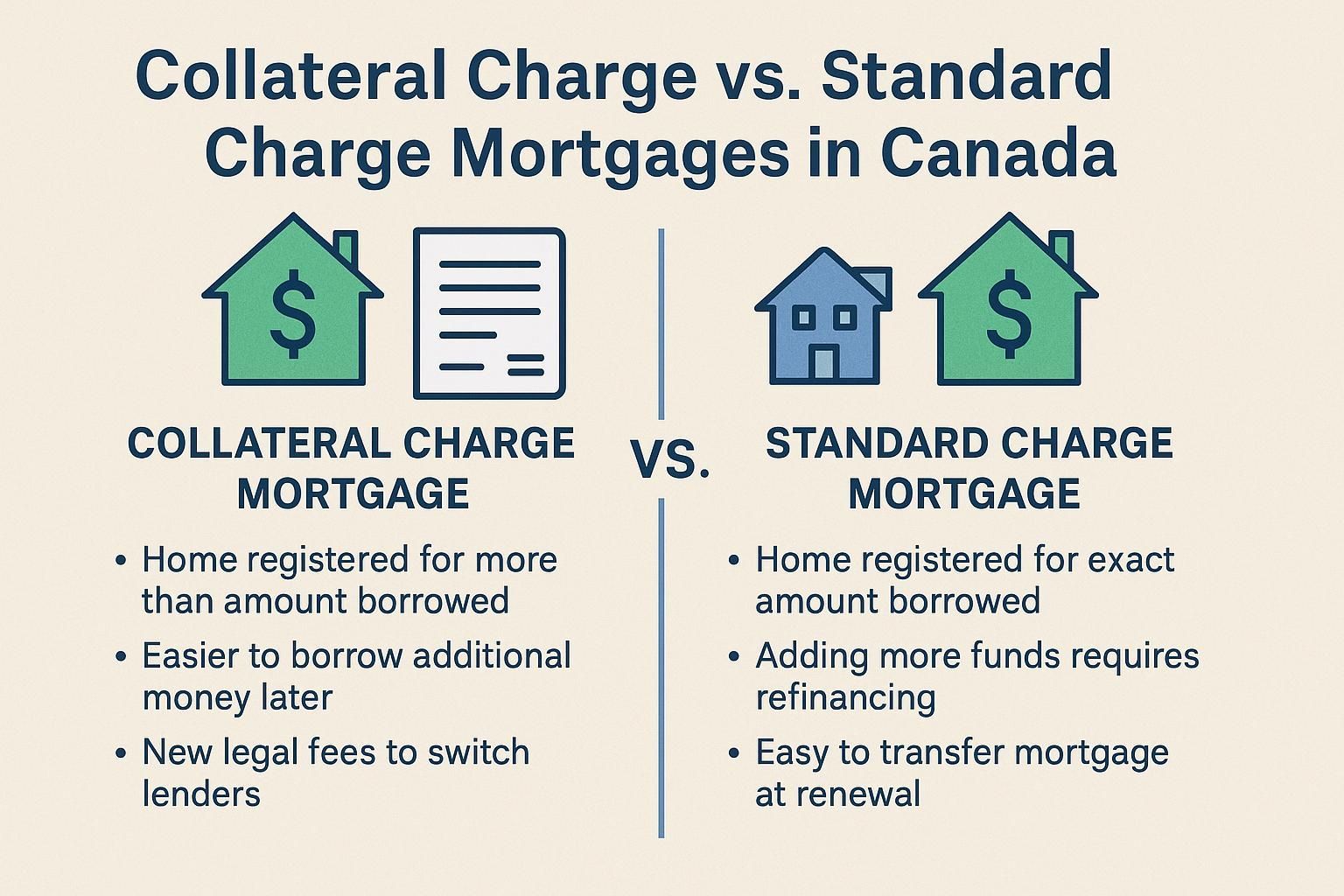

When you’re buying a home in Canada, you’ll hear a lot of new terms. One of those is how your mortgage is registered: as a standard charge or a collateral charge . This choice matters because it affects your flexibility, your costs if you ever switch lenders, and how easy it is to borrow more money later. Let’s break it down in simple terms.

British Columbia’s real estate landscape has changed dramatically over the past 15 years. Since 2010, we've seen waves of new legislation, tax policies, zoning reforms, and consumer protections that affect how homes are bought, sold, financed—and lived in. Whether you're a first-time homebuyer or a seasoned investor, keeping up with all these changes can feel overwhelming. That’s why working with a knowledgeable mortgage broker has become more important than ever. Here are 20 key real estate changes in BC since 2010 —and how they affect you.

Home buyers say the #1 obstacle to homeownership is saving enough money for a down payment. Mortgage default insurance (also called mortgage insurance) allows you to purchase a home with as little as 5% down . It protects your lender if you stop making payments. Typically, a 20% or higher down payment is your best option. However, for many Canadians, reaching this amount can be challenging, especially in expensive markets like Greater Vancouver & Toronto. If you don't have enough cash for a 20% down payment, Mortgage Default Insurance can help. How Much Down Payment Do You Need?