Joint Tenants vs. Tenancy in Common – What You Need to Know When Purchasing a Home!

Joint Tenancy

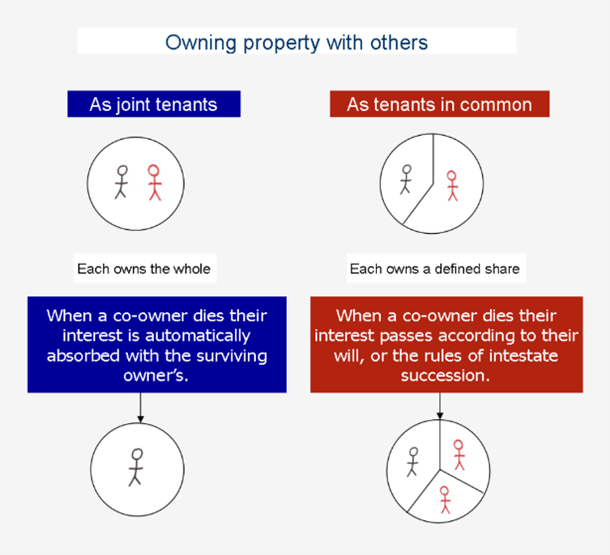

In a joint tenancy, each co-owner owns an undivided interest in the whole of the fee simple estate, and together, all co-owners own the whole of the property. The essential feature of this type of ownership is the right of survivorship. When one joint tenant dies, the entire estate remains with the surviving joint tenants. The result is that the surviving joint tenants acquire the whole of the estate and this continues until there is a sole survivor. Therefore, joint tenants cannot leave their interest to anyone in their wills.

- The default ownership for most couples is joint tenancy.

Tenants in Common

Where 2 or more persons hold interests in a property, and each has a separate share.

While none of the owners may claim a specific area of the property, tenants in common may have unequal shares and different ownership interests.

- For instance, Tenant A and Tenant B may each own 25% of the home, while Tenant C owns 50%.

- Tenancies in common also may be obtained at different times, so an individual may get an interest in the property years after one or more other individuals have entered into a tenancy in common ownership.

Each owner may sell or bequeath their interest in the property.

Terminating Joint Tenancy vs. Tenancy in Common

Joint Tenancy can be broken if one of the co-owners transfers or sells his or her interest to another person, thus changing the ownership arrangement to a tenancy in common for all parties.

- This type of holding title is most common between couples and among family members in general since it allows the property to pass to the survivors without going through probate (saving time and money).

Tenants in Common can be broken if one of the following occurs:

- One or more co-tenants buys out the other(s).

- The property is sold and the proceeds distributed amongst the owner’s.

- A partition action is filed, which allows an heir to sell his or her stake.

- At this point, former tenants in common can choose to enter into a joint tenancy via written instrument if they so desire.

For more information about the difference between joint tenancy and tenancy in common – contact your real estate lawyer.

Mortgages are complicated, but they don’t have to be… Engage an expert!

Kelly Hudson

Mortgage Broker

Mortgage Architects

Mobile: 604-312-5009

Kelly@KellyHudsonMortgages.com

www.KellyHudsonMortgages.com