Collateral Charge vs. Standard Charge Mortgages in Canada

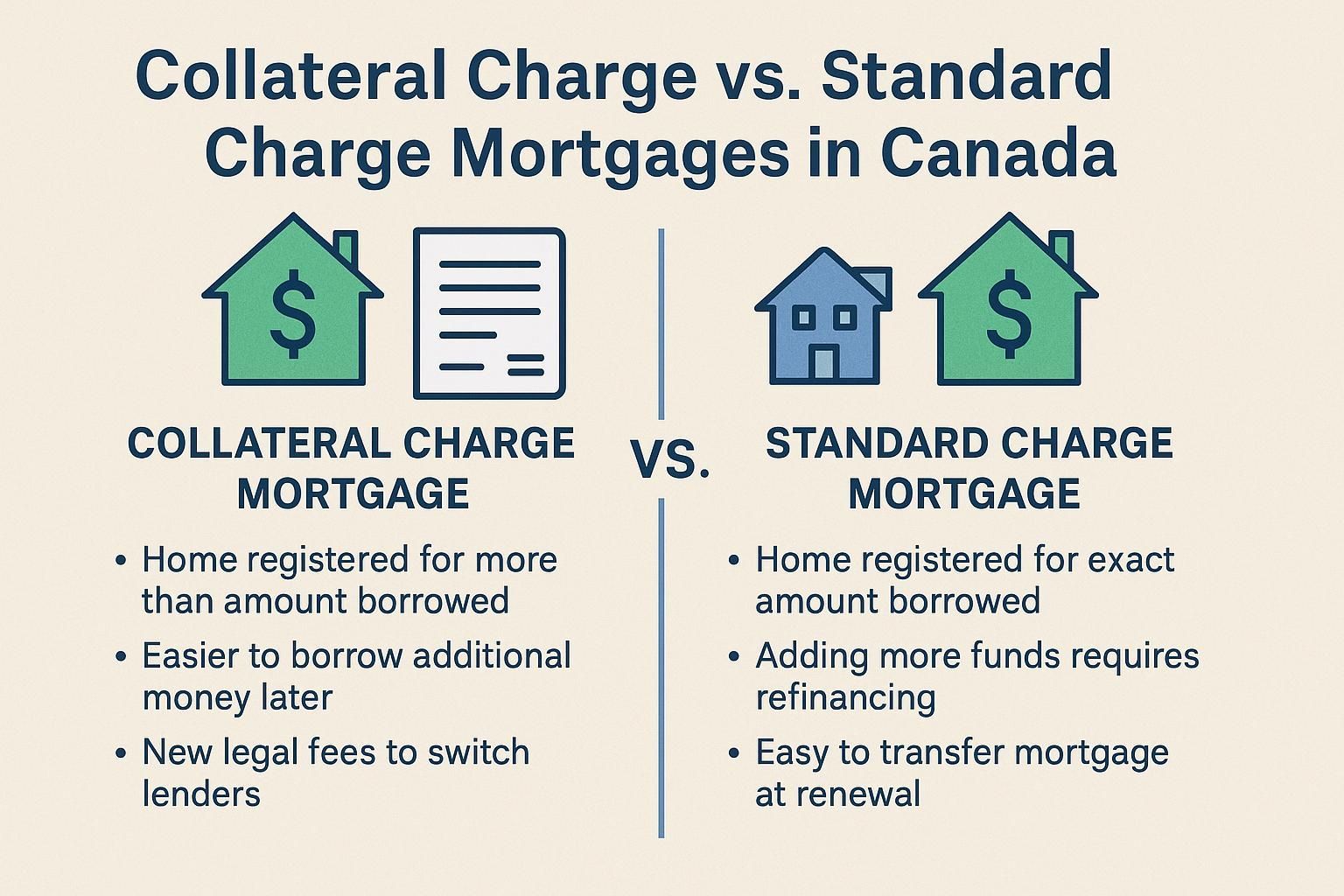

When you’re buying a home in Canada, you’ll hear a lot of new terms. One of those is how your mortgage is registered: as a standard charge or a collateral charge.

This choice matters because it affects your flexibility, your costs if you ever switch lenders, and how easy it is to borrow more money later. Let’s break it down in simple terms.

What’s the Big Difference?

Both types of mortgages let you borrow money to buy your home. The difference comes in

how the lender registers the loan against your property.

- Standard Charge Mortgage

This is the traditional way most lenders register mortgages. The charge is for the exact amount you borrow. For example, if your mortgage is $400,000, the charge is for $400,000. - Collateral Charge Mortgage

This type registers your home for more than the amount you actually borrow—sometimes up to 100% or even 125% of your home’s value. So, if you borrow $400,000 on a $500,000 home, the lender might register it as $625,000.

Why? Because it makes it easier to borrow more later—without hiring a lawyer again or paying extra legal fees.

Advantages of Collateral Charge Mortgages

- Easy Access to Equity

If your home goes up in value or you want to use equity for renovations, debt consolidation, or investments, you can often access those funds directly with your lender. - You need the income to qualify for the larger mortgage

- No New Legal Fees

Since the mortgage is already registered for a larger amount, you don’t have to pay a lawyer if you want to increase your mortgage with the same lender. - Good for HELOCs

Home Equity Lines of Credit (HELOCs) are always registered as collateral charges. They’re designed for people who want ongoing access to their home equity.

Downsides of Collateral Charge Mortgages

- Harder to Switch Lenders

If you want to change lenders at renewal to get a better rate or different features, you can’t just “transfer” your mortgage for free. With a collateral charge, most lenders require you to start fresh, which means paying new legal fees—anywhere from $1,000 or more. - Negotiating Power is Limited

Since switching to a new lender will cost more, you may lose some leverage when asking your current lender for a better deal. - Second Mortgages Can Be Tricky

Because the collateral charge takes up more of your home’s value, it may block other lenders from giving you a second mortgage—unless your home value has increased a lot.

Advantages of Standard Charge Mortgages

- Easy to Switch Lenders

At renewal, you can shop around and transfer to another lender with little or no cost. This helps keep your options open and gives you stronger negotiating power. - Simple and Clear

Your mortgage is registered for exactly what you borrow. If you need more money later, you can add a second mortgage or line of credit. - Fewer Surprises

Because the registered amount matches what you owe, you know exactly where you stand.

Downsides of Standard Charge Mortgages

- Extra Legal Fees if You Refinance

If you want to borrow more money later (say for renovations), you’ll usually need to hire a lawyer and pay legal fees. - Less Built-In Flexibility

Unlike collateral charges, standard charges don’t give you instant access to more equity without extra steps.

What’s Changed in the last 10 years?

Back in 2014, TD and ING (now Tangerine) had already switched to collateral charges for all new mortgages. Today, most major banks in Canada still use collateral charges for HELOCs and some mortgage products. Some lenders continue to offer standard charge mortgages, especially credit unions and non-bank lenders.

The key difference now is that

more borrowers are aware of the trade-offs. With rising home prices and tighter mortgage rules (like the stress test), being strategic about how your mortgage is registered matters more than ever.

Which One Is Right for You?

- Choose a Collateral Charge Mortgage if:

- You think you’ll want to refinance for renovations, investments, or debt consolidation.

- You value flexibility plan on staying with the same lender long-term.

- Choose a Standard Charge Mortgage if:

- You want the ability to shop around at renewal without extra costs.

- You don’t expect to refinance.

- You want to simply pay off your mortgage with no surprises.

Final Word: Talk to a Mortgage Broker

Every homeowner’s situation is different. Choosing between a standard or collateral charge mortgage adds one more decision to an already big process.

That’s where a mortgage broker can help. Brokers work with many different lenders, explain the pros and cons, and guide you to the option that fits your goals. Whether you value flexibility, lower fees, or freedom to shop around, getting expert advice makes the choice much easier.

Bottom Line: A collateral charge mortgage gives you flexibility to borrow more later but limits your ability to switch lenders cheaply. A standard charge mortgage makes it easier to shop around but may cost more if you need to refinance. The right choice depends on your long-term plans—and that’s why expert advice from your mortgage broker is key.

Are you considering buying a home? As you can tell there is lots to discuss, let’s have a chat and find a mortgage that works for you and not the bank.

Kelly Hudson

Mortgage Expert

Mortgage Architects – A Better Way

Mobile: 604-312-5009

Kelly@KellyHudsonMortgages.com

www.KellyHudsonMortgages.com