Rental Property Management in BC

Greater Vancouver Property Management Fees – What You Need to Know

Owning a rental property in Greater Vancouver can be a smart way to build wealth. But if you have ever tried to manage a rental on your own, you already know it takes more than just collecting rent. From finding the right tenant to fixing leaky faucets, the work can add up fast.

That’s why many owners hire a property manager. A good property manager takes care of the day-to-day tasks and helps you avoid costly mistakes. But before you sign a contract, you’ll want to understand how property management fees work and what you get for your money.

Let’s break it down in simple terms.

What Is a Property Manager?

A property manager is a licensed professional who looks after your rental property for you. In British Columbia, property managers must complete special training and get a licence from the BC Financial Services Authority (BCFSA). This means they follow strict rules and stay up to date on important laws such as the BC Residential Tenancy Act.

A good property manager knows Greater Vancouver’s rental market and keeps up with changes to taxes and local rules. For example, the

City of Vancouver’s Empty Homes Tax is now

5% of the property’s assessed value for 2025—something an experienced manager will help you handle.

What Does a Property Manager Do?

A property manager wears many hats. Here are some of the main jobs they handle:

- Set the right rent. They study market rents, so your rent is high enough to earn a good return, but not so high that it scares away renters.

- Advertise your place. From taking great photos to posting on popular rental sites they make sure people see your property.

- Screen tenants. They check credit, references, and employment so you get reliable tenants who pay on time.

- Handle the paperwork. They prepare and sign the lease (called a tenancy agreement) and organize move-in and move-out inspections.

- Collect rent. They make sure the rent shows up in your bank account every month.

- Take care of repairs. Whether it’s a broken dishwasher or regular maintenance, they arrange for trusted tradespeople to get the job done.

- Keep records. Each month you get a statement showing rent collected and expenses paid. At year-end you get a summary that makes tax time easier.

- Special services. For owners who live outside Canada, they can also look after the required non-resident tax filings.

How Much Do Property Management Fees Cost?

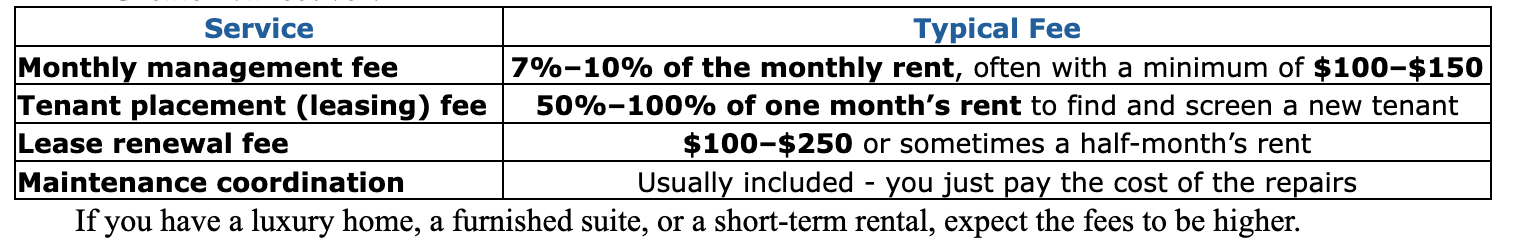

Fees can vary depending on the type of property and the company you hire. But here are the

typical 2025 rates in Greater Vancouver:

Why Hiring a Property Manager Can Be Worth It

It might seem cheaper to do everything yourself. But a property manager can actually save you both time and money.

1. Less Stress, More Free Time

No late-night phone calls about a broken furnace. No chasing tenants for late rent. Your manager handles it.

2. Better Tenants, Fewer Vacancies

Managers often have a list of pre-screened tenants and work with relocation companies. This can mean your place is rented faster and stays occupied.

3. Local Knowledge

Vancouver’s rental rules and taxes change often. A licensed manager keeps you on the right side of the law.

4. Bulk Savings on Repairs

Because they work with many properties, managers often get better prices from contractors and can pass those savings on to you.

5. Peace of Mind—Even From Far Away

If you live in another city or province, a property manager can be your eyes and ears on the ground.

Tips for Choosing the Right Property Manager

- Check their licence. Make sure they are licensed with the BCFSA.

- Compare more than one company. Get quotes and see what services are included.

- Read the contract. Know exactly what you’re paying for and any extra fees.

- Ask for references. Talk to other owners to hear about their experience.

The Bottom Line

Property management fees in Vancouver—usually 7%–10% of the rent plus a tenant-placement fee—aren’t just another expense. They’re an investment in protecting your property and your time.

A good property manager keeps your rental running smoothly, makes sure you follow the rules, and helps you get the best return on your investment. For most landlords, that peace of mind is worth every penny.

Need help navigating mortgage financing options for rental properties? I’d be happy to help!

Kelly Hudson

Mortgage Broker

604-312-5009

Kelly@KellyHudsonMortgages.com

www.KellyHudsonMortgages.com